Over the past several months we have seen several important developments in patient loyalty generally, and in the coupons and co-pay space in particular. Just some of the hot topics in this arena include:

- Value of increased adherence: Does increased adherence save payers money? How important is adherence as HCPs select between therapeutic alternatives? What’s with the growing move toward “affordability messaging?”

- Anti-Kickback Statute: Is there any leeway to allow co-pay assistance for low-income patients? What about giving assistance to patients waiting for Rx approval or for drugs without cheaper alternatives?

- Cap the Co-pay movement: What states are making moves now? How are manufacturers and payers reacting?

- Managed-care formulary blocks: What are the newest steps insurers are taking to block access to “expensive” brands? What do providers and patients think about that strategy? What are drug makers doing in response?

- Technology: Do adherence apps show any value? How about robots—any adherence benefit? What’s happening with digital pillboxes and smart bottles/caps?

But as I survey the coupon and co-pay landscape, the most newsworthy issue I see is the continuing effort by payers to shift drug costs to patients. Let’s take a few minutes to try to understand what’s happening, how patients are reacting, and where we might go from here.

The Ever-rising Drug Co-pay

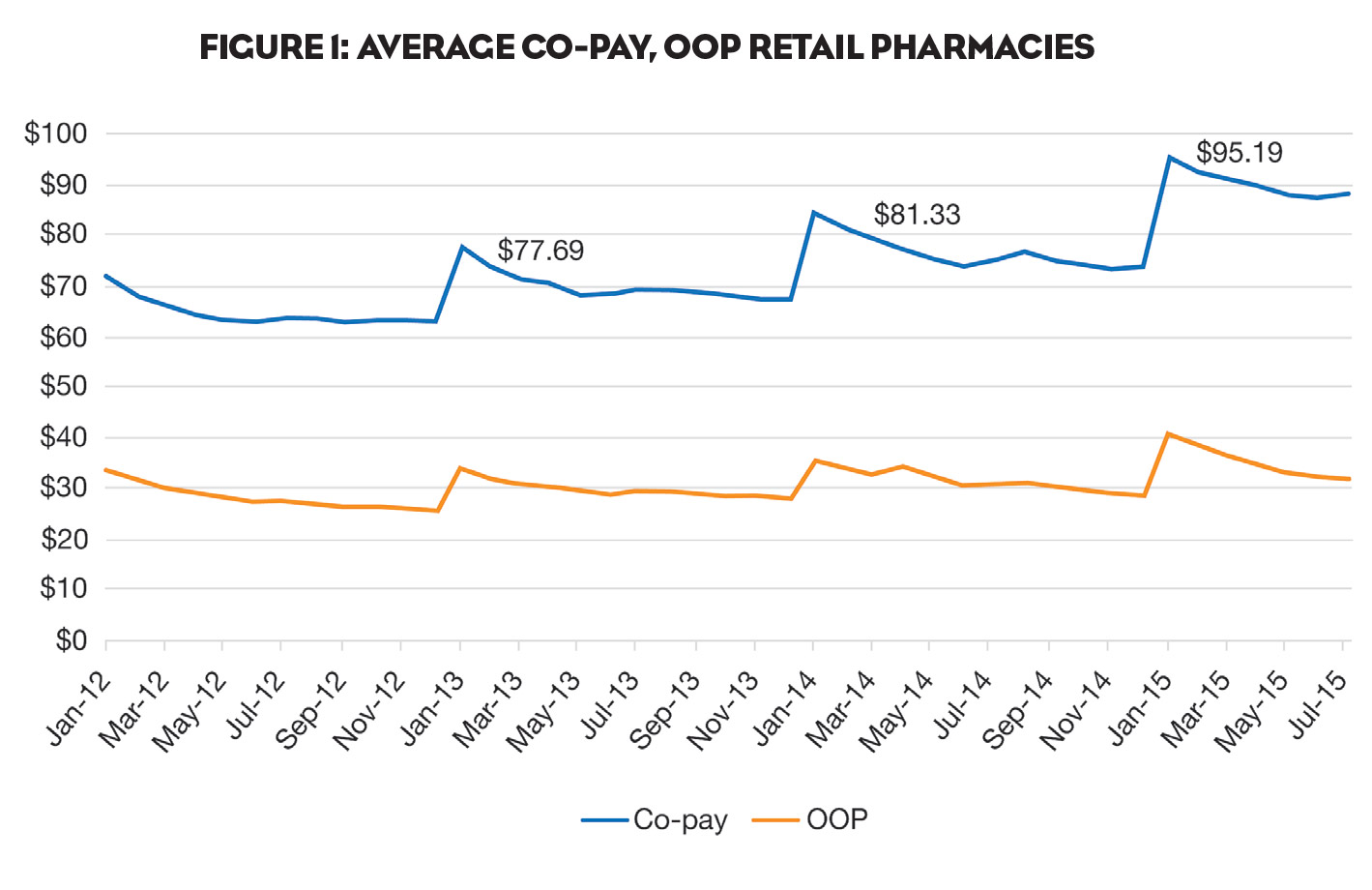

As shown in Figure 1, co-pays for branded products continue to spike each January and settle at a higher level than the year before.

Overall, nearly half of continuing patients experienced some price increase in the cost of their therapy. And more than 15% experienced an increase of 100% or more.

It’s also important to understand that it’s not just co-pays that reset each January. Deductibles reset, too. And where can we look to best evaluate the effect of increasing deductibles? High-deductible plans.

High-deductible Plans

According to Becker’s Hospital Review, in 2015 more than 24% of individuals participating in employer-sponsored coverage chose high-deductible health plans, up from 20% in 2014. Becker’s goes on to note that these plans are “a viable means for employers to control healthcare costs by shifting expenses from companies onto employees.” And it’s going to get even worse. Becker’s quotes PwC’s Health Research Institute in predicting that 44% of employers are expected to offer high-deductible plans as the only benefit option for employees within the next three years.

But the evidence suggests that high-deductible (HD) plans hurt patient medication persistency. Even when HD patients continue therapy in January—despite spikes in co-pays—they have lower persistency. In 2015, patients for a GI product who saw a spike in their co-pay averaged 3.9 card uses (YTD August) versus 5.1 uses for similar patients who did not see a spike in their co-pay.

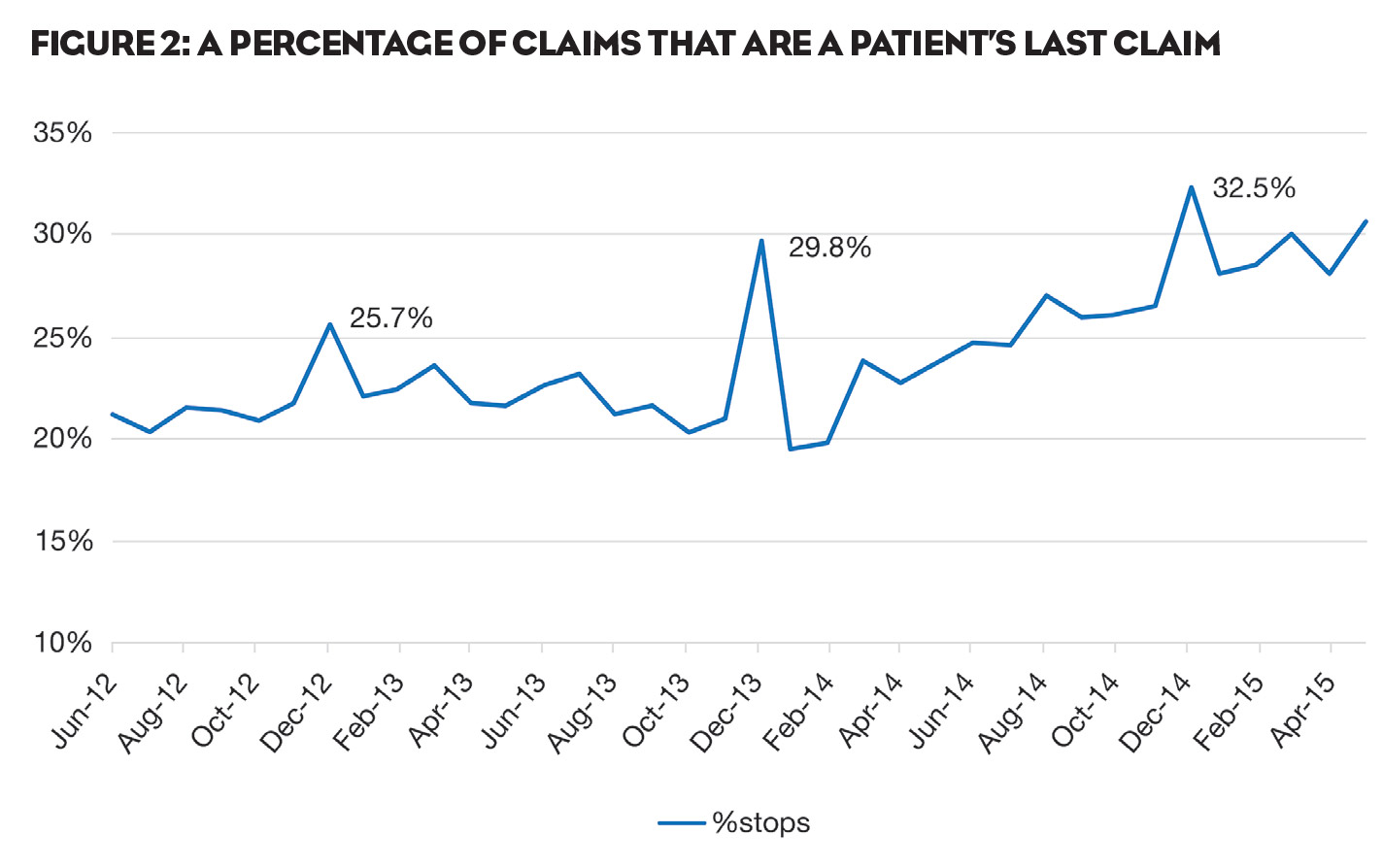

With these unrelenting increases in out-of-pocket drug costs, it’s not surprising that patients shift their behavior accordingly. For many, the default option is prescription abandonment. Indeed, as shown in Figure 2, a disproportionate number of coupon patients made their last program redemption in December (the last month before deductibles and co-pays reset), suggesting that the cost of therapy spiked sufficiently in January to cause them to stop treatment.

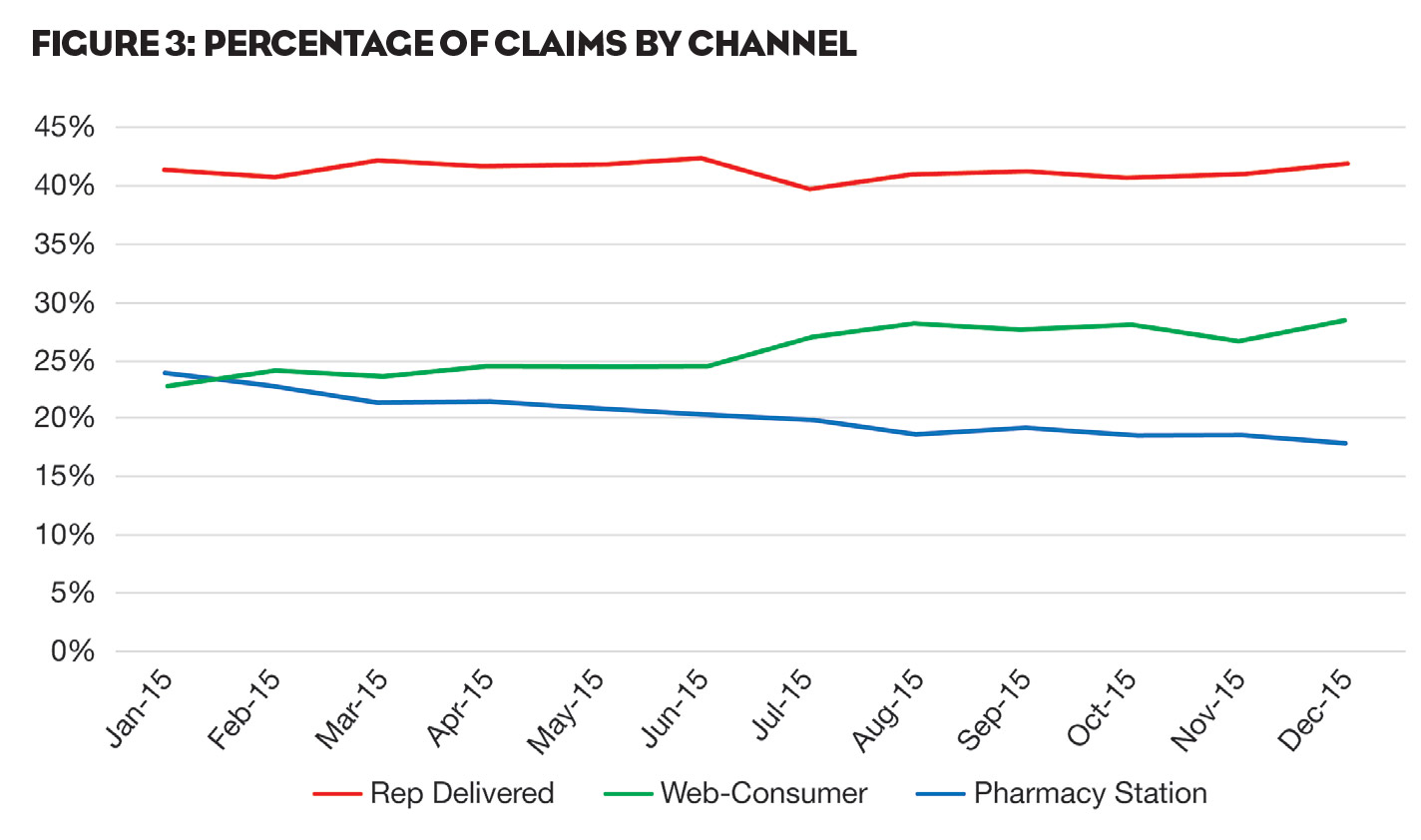

But abandonment isn’t the only option. An increasing number of patients are actively searching for more financial assistance to stay on therapy. As shown in Figure 3, 2015 saw a substantial upturn in the percentage of our claims coming as a result of patients using Web-based offers (green line). This trend started in July and picked up steam from there. We believe that patients may well be reacting to the significant increases in the costs of prescription medicines. As a result, more and more of them are actively looking for help on the Web. It also speaks to the acceptance of co-pay support by patients, particularly insured patients with deductibles.

Where will it all end? While no one can be sure, it seems likely that—at least for the foreseeable future—the cycle of escalation will continue, increasing efforts by payers to shift costs to patients, increasing efforts by patients to reduce their out-of-pocket costs, and increasing efforts by manufacturers—as well as from “cap the co-pay” regulatory efforts—some relief to patients’ wallets will be necessary.